Close Advanced Search Filters

Search

Companies

Topics

Content Types

Results: (96)

Advanced Search Filters

Clear Filters

Thursday, February 19, 2026

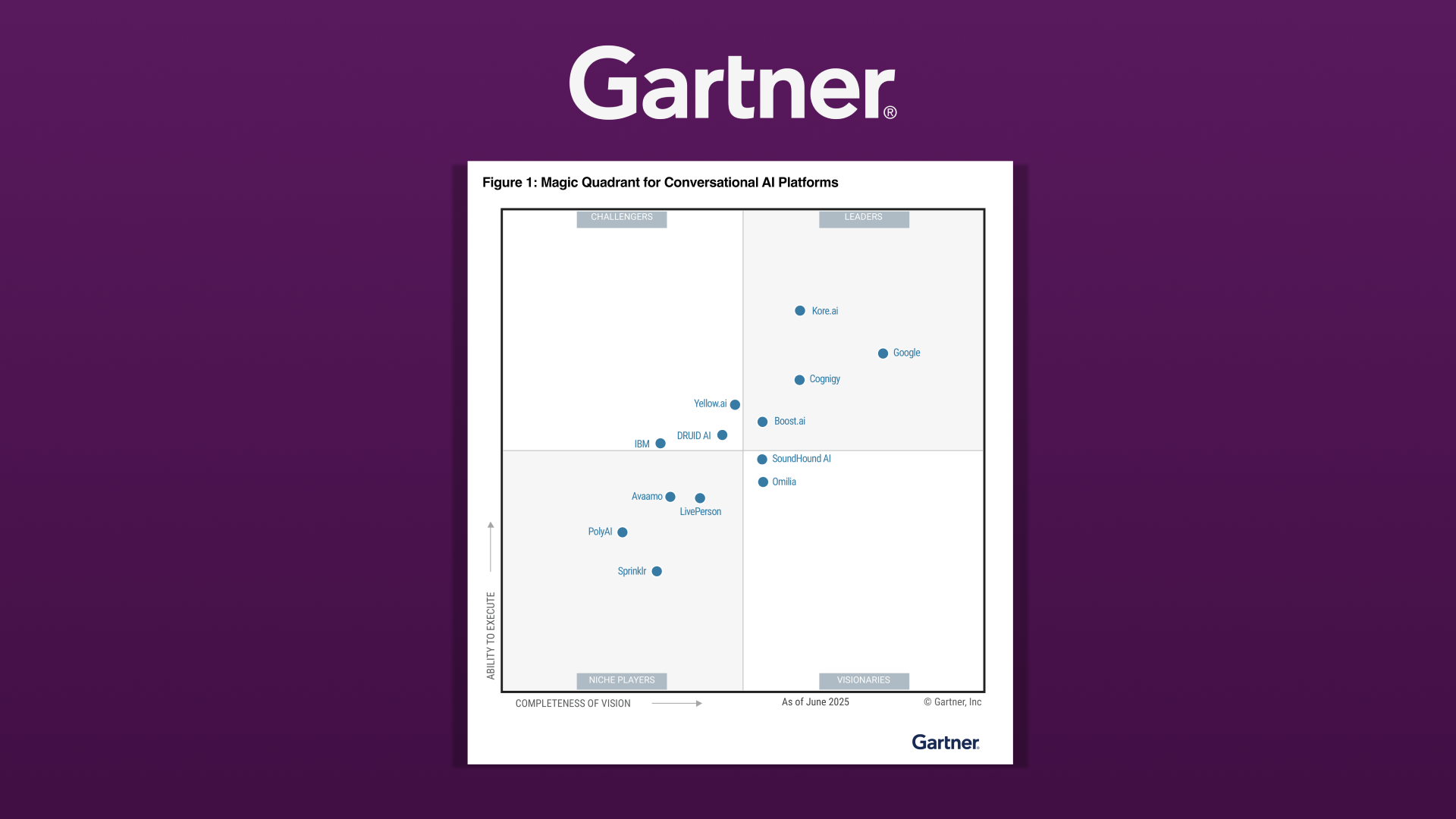

Boost.ai

Designing conversational AI that sounds like your brand

In this on-demand conversation, we explore what actually drives conversational quality in production AI systems — and why brand misalignment is often a symptom of deeper challenges in knowledge structure, conversation design, and system orchestration.

Tuesday, February 3, 2026

Boost.ai

SPARK Matrix™ for Conversational AI Platforms

boost.ai Named a Leader in the QKS SPARK Matrix™ for Conversational Platforms. Recognized for technology excellence and customer impact, boost.ai helps regulated organizations move fast - without compromising security, compliance, or control. Explore the findings from the report.

Tuesday, January 27, 2026

FI Strategies

Sales Camp: A Practical Framework for Building a Sustainable Sales Culture at Your Credit Union

Credit unions across the country know they need to grow, but many struggle to translate “deeper relationships” into consistent, measurable action. This executive overview outlines what it really takes to build a sales culture that aligns with your values and actually sticks.

Friday, December 19, 2025

LemonadeLXP Inc

The Compliance Training Revolution

Traditional compliance training isn’t cutting it. It’s slow, forgettable, and frustrating—and when your team’s not prepared, the risks are real. This ebook unpacks how game-based learning is changing the game, making compliance training more engaging, effective, and easier to manage.

Thursday, December 18, 2025

LemonadeLXP Inc

From Clicks to Confidence: Driving Digital Adoption in Banking

Explore how credit unions can overcome digital adoption challenges by building confidence at every level—customers, frontline staff, and internal teams. Marketing, operations, and training together can turn digital transformation from a tech initiative into a growth engine.

Wednesday, December 17, 2025

LemonadeLXP Inc

5 Ways AI Is Transforming Training and Support in Financial Institutions

From simplifying content creation to delivering real-time answers, AI is helping financial institutions train smarter, support faster, and stay compliant. This guide explores five practical ways to make AI work for your team.

Friday, December 12, 2025

Franklin Madison

You Might Not Recognize Today’s Insurance Buyer

The modern insurance buyer is no longer defined by a single age group or life stage.

Tuesday, December 2, 2025

FI Strategies

Four Steps to a Culture Your Competitors Can’t Replicate

Most culture initiatives fail because they rely on slogans, perks, or top-down declarations. This guide shows you how to build a culture that shapes behaviors, strengthens alignment, and improves results across your organization.

Wednesday, November 19, 2025

Franklin Madison

What You Need to Know About Women and the Great Wealth Transfer

Money is power, and over the next two decades an estimated $124 trillion will move from Baby Boomers and older Americans to younger generations in the U.S.

Thursday, October 2, 2025

Boost.ai

Trends, insights and prediction for conversational AI in 2025 - and beyond

The rapid push to adopt AI has created “hyperfatigue” and a critical demand for measurable ROI. This guide – complete with trends, insights and predictions from industry experts – provides a clear roadmap to move from AI exploration to strategic validation.

Wednesday, October 1, 2025

Elan Financial Services

Download Your Consumer-Credit Blueprint

Financial institutions that provide customers with personalized education and proactive support can strengthen trust, deepen relationships, and grow long-term impact. Download the full whitepaper to learn more.

Thursday, September 25, 2025

Boost.ai